How to calculate your federal income tax refund

How to calculate your federal income tax refund

For many Americans, tax season can bring about a windfall in the form of a Federal income tax refund check. You will receive a refund check if and only if you paid more then your total tax debt over the course of the year through tax witholding. This article will teach you how to calculate your expected tax refund, and how to ensure that your refund check reaches you successfully.

Calculating Your Total Tax and Total Payments

The size of your federal tax refund depends on two things – your total tax owed and your total tax witholding.

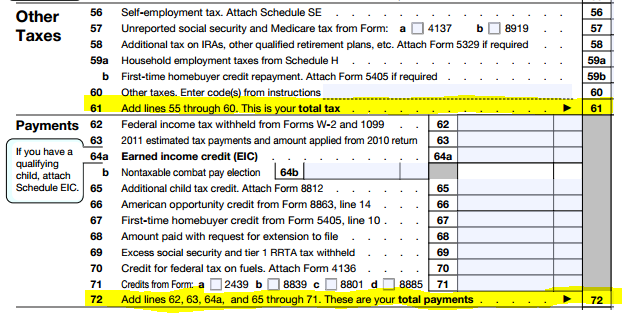

- Calculate your total tax (including all deductions, adjustments, and other taxes) on line 61 of your 1040 form. This is the amount you owe.

- Calculate your total tax payments on line 72. Tax payments include all income tax withheld by your employer on line 62 (check your W-2 or 1099 forms), estimated tax payments on line 63, and any tax credits you may qualify for. The total on line 72 is your total tax paid.

Calculating Your Income Tax Refund

Your tax refund is simply the difference between the amount you paid and the amount you owe. If you paid too much, you have several options for your refund.

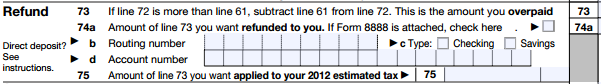

- If your total payments on line 72 are greater then your total tax owed on line 62, write the difference in the refund box on line 73.

- In lines 74 and 75, you can choose to have your refund paid to you (as a check or through direct deposit) or applied directly to next year’s taxes (useful if you have to pay estimated taxes).

Getting Your Tax Refund Quickly

Now that you’ve calculated your refund, there are several steps you can take to ensure you receive it in a timely manner.

- eFile Your Tax Return – The IRS has to process millions of tax returns every year – if you eFile, they will be able to process your return (and your refund) much more quickly. eFiled returns will receive refunds in as little as 1-3 weeks, while paper returns can take up to 6 weeks to be processed.

- Request Direct Deposit – Requesting that your refund be direct deposited instead of requesting a check can also speed up your refund process by up to a week. Direct deposit is fast and secure, and you can choose up to 3 separate accounts (including checking, savings, and retirement accounts) to receive your refund. You can request direct deposit on line 74 of your 1040.

If you eFile your tax return, you can expect to receive your refund within 10-21 days.

Checking Your Refund Status

Starting 72 hours after you eFile (or 4 weeks after you mail a paper return), you can check on your refund’s status through the IRS’ “Where’s My Refund?” system. Â Collect the following information before making your refund inquiry:

- Your Social Security Number

- Your current filing status

- The dollar amount of the refund you requested (from line 73 of your 1040)

With this information in hand, you can check the status of your refund either online or over the phone by calling the IRS Refund Hotline at  1-800–829–1954 or by logging onto the IRS Where’s My Refund website.

Solving Problems With Your Refund

If you received an incorrect refund amount, your refund was never issued , or your refund check was lost or stolen, contact the IRS immediately at 1-800-829-1040Â and they will be able to reissue your refund as necessary.

Getting Your State Income Tax Refund

If your state collects income tax, you must apply for a refund on your state income tax return, and you will receive a separate refund payment. Most states also provide an easy-to-use refund status portal – see your state’s income tax information page for more details.

How can we improve this page? We value your comments and suggestions!

How can we improve this page? We value your comments and suggestions! Send Instant Feedback About This Page

Donate BitCoin:

Donate BitCoin: