TurboTax 2012 Income Tax Software Review

TurboTax 2012 Income Tax Software Review

Warning: include(/includes/module_taxaffiliates.php): failed to open stream: No such file or directory in /home/taxrates-legacy/public_html/wp-content/plugins/exec-php/includes/runtime.php(42) : eval()’d code on line 4

Warning: include(): Failed opening ‘/includes/module_taxaffiliates.php’ for inclusion (include_path=’.:/usr/share/pear:/usr/share/php’) in /home/taxrates-legacy/public_html/wp-content/plugins/exec-php/includes/runtime.php(42) : eval()’d code on line 4

Tax law is exceedingly complicated, and as many who have attempted to wade through piles of tax paperwork on their own can attest, often exceedingly frustrating to deal with manually. For many Americans who choose to handle their tax returns themselves, completing and double-checking tax forms can turn into a nightmare.

Luckily, dozens of tax software suites make it possible and even easy to manage and submit your tax returns online. Tax-Rates.org has reviewed some of the best income tax software available in order to help you choose the tools that are right for you.

- Contents

- TurboTax Software Review

- H&R Block At Home Software Review

TurboTax Federal & State Tax Software

TurboTax is a powerful tax suite that can handle both federal and state tax returns. The program is designed to ensure that you receive your maximum tax refund with simple multiple-choice questions that can help you claim over 350 updated deductions.

Pros: One of the best features about TurboTax is the wide variety of time-saving tools and features available. TurboTax can import tax data from previous years (even if you didn’t use TurboTax), and can instantly load W-2 forms and other tax information directly from your employer. This can save an incredible amount of typing and time.

Cons: The popular free version of TurboTax supports both federal and state returns, but only supports free e-filing for your federal return. You can print and send your state return in for free, but you have to purchase a state e-filing package ($39.95) if you want to e-file your state income tax return as well.

TurboTax has four editions, ranging from free software for basic returns to a full-service tax prep suite for self-employed business owners. You can compare the features, and price, using the table below.

| Price & Features Comparison of TurboTax 2012 Editions | |

|---|---|

|

TurboTax Free Edition This edition is FREE if you file form 1040EZ

|

$0.00 Buy

|

|

TurboTax Deluxe Edition Suitable for most filers earning W-2 wages and 1099s. Supports 300+ deductions and credits

|

$49.95 Buy  |

|

TurboTax Premier Edition Specifically for taxpayers with investment income or rental properties

|

$74.95 Buy

|

|

TurboTax Home & Business Edition Files both advanced personal and business returns for self-employed taxpayers

|

$99.95 Buy

|

We found all editions of TurboTax to be intuitive and easy to use – the software offers turn-by-turn instructions and helpful suggestions to help you navigate through the various refunds and tax credits available, and can import and double-check all of the tax forms seamlessly in the background.

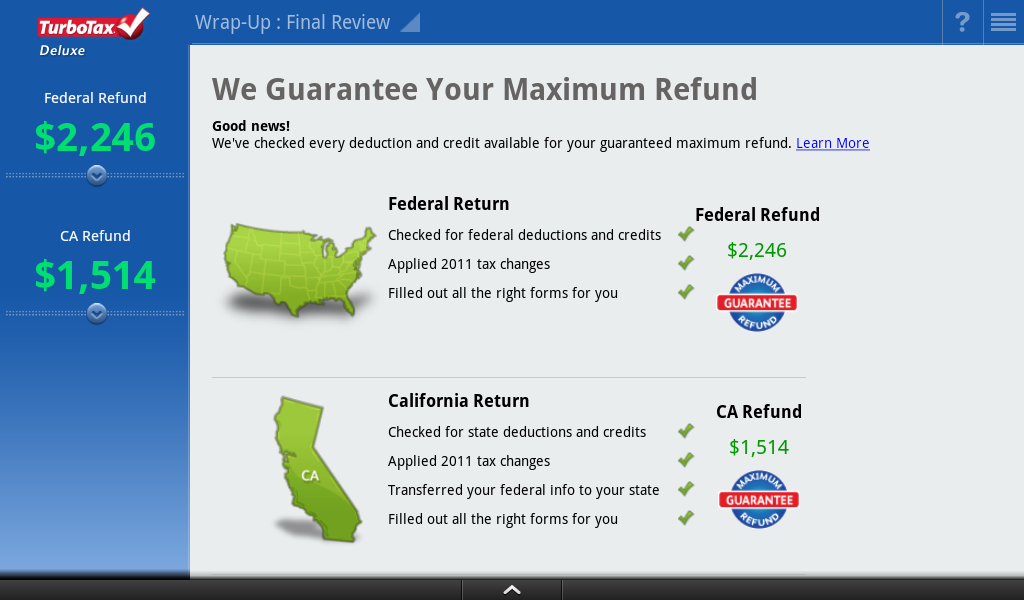

The program has been designed around prominently maximizing your refund on both your federal and state tax returns, as can be seen in the example screenshot below:

Overall: TurboTax is arguably one of the most well-rounded tax suites available, and definitely goes the extra mile when it comes to saving time and maximizing your tax refund.

If you have a simple tax return (with only wage income and 1099s), TurboTax Free is unbeatable for e-filing your federal return, both in ease and price.

For only $49, the deluxe edition is also an excellent buy for most taxpayers that offers the same or better guidance for a much more affordable price then a professional tax preparer.

Learn more about TurboTax Income Tax Filing Software

How can we improve this page? We value your comments and suggestions!

How can we improve this page? We value your comments and suggestions! Send Instant Feedback About This Page

Donate BitCoin:

Donate BitCoin: