How to get a six-month extension to file your income tax return

How to get a six-month extension to file your income tax return

By Jonathan Weber, Tax-Rates.org

Millions of Americans wait until the last minute to file their income taxes – and many find that they just can’t do it in time for the April 15th deadline. Luckily, the IRS cuts some slack for tax procrastinators – provided they still pay the taxes they owe on time.If you need more time to file your personal income tax return, you can get an automatic six-month extension to your tax return filing deadline by following the instructions on this page. This will give you until October 15th to submit your Form 1040.

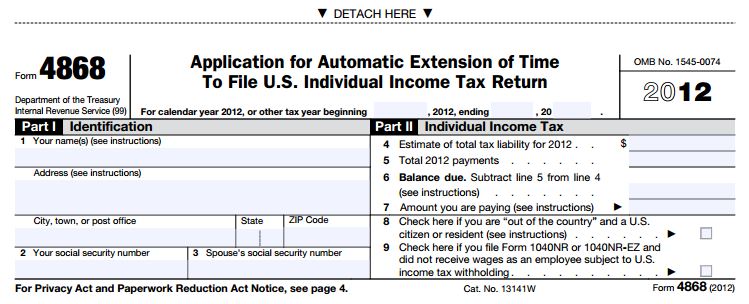

To get this automatic extension, you need to file IRS Form 4868 – aptly named “Application for Automatic Extension of Time To File U.S. Individual Income Tax Return” – by April 15th. This simple form will ask you for your taxpayer info and an estimate of your owed tax, calculated using the info you have available to you now.

You must make sure that you have paid the IRS the full amount of your estimated tax liability by April 15th, because getting an extension only protects you from late filing fees – not late payment fees or interest. It is in your best interest to overpay what you expect you actually owe, and then get the overpayment back as a tax refund when you do get around to filing your completed tax return.

If you do not think you can file in time, it is essential that you file Form 4868 with the IRS – failure to file on time without asking for an extension can result in late-filing fees of 5% of your owed tax per month – or up to a total of 25% of your tax liability.

Form 4868 can be e-filed, mailed, or submitted using most commercial tax prep software packages. You can download a PDF copy of Form 4868 from Tax-Rates.org here.

How can we improve this page? We value your comments and suggestions!

How can we improve this page? We value your comments and suggestions! Send Instant Feedback About This Page

Donate BitCoin:

Donate BitCoin: