How to deduct business expenses on your income tax return

How to deduct business expenses on your income tax return

By Jonathan Weber, Tax-Rates.org

In this article, we will discuss who can qualify for business expense deductions, what expenses can be deducted, and how your deductions must be recorded and reported.

The information discussed in this article is relevant to entrepreneurs, self-employed people, business owners and shareholders, and employees who have paid out-of-pocket business expenses.

What Business Expenses Can Be Deducted?

While the exact deductions you can take depends on the tax structure and nature of your business, in most cases sole proprietors can deduct the following qualified expenses from their gross business income:

- Cost Of Goods Sold – The cost of any goods or raw materials you purchase and resell is always 100% deductible. For example, a woman who sells paintings at a local craft show will be able to deduct the costs of paint and canvas for each piece sold.

- Advertising -Â All advertising fees are fully deductible. Examples include classified ads in the local paper, radio or television ads, and most sponsorships

- Business Supplies & Tools -Â The cost of any supplies and tools needed exclusively for business use are fully deductible. For an artist, any purchases of paintbrushes, easels, and other supplies can be deducted.

- Vehicle Expenses -Â Certain vehicle expenses – including rental costs and mileage – can be deducted for qualifying business use of your vehicle. Commuting expenses cannot be deducted.

- Contract Labor & Services -Â If you hire contractors or freelancers to work for your business, fees are fully deductible. You can also deduct fees paid to hire professionals such as lawyers and repairmen for business-related services.

- Office Expense -Â You can deduct any costs associated with maintaining your business workplace or office. If you work from home, you can deduct the percentage of your home costs directly related to your business.

- Travel & Entertainment -Â You can deduct travel-related business costs, and up to 50% of your qualifying business entertainment costs. All travel and entertainment costs deducted must be related solely to your business, and cannot include any recreational expenses.

- Additional deductions including depreciation, depletion, taxes, and insurance premiums may also be deductible based on your particular situation.

Who can deduct business expenses?

Business expenses are normally associated with corporations – entities which are distinct and separate from the owner(s) and employees. In most cases, business expenses are reported on a corporate income tax return instead of on a personal income tax return.

However, there are a variety of situations in which you, the taxpayer, may wish to deduct business expenses on your own personal income tax return. If you are a self employed professional, own a home-based business, or are a shareholder in an S-Corporation or partnership, your business deductions can be listed directly on (or passed through to) your personal income tax return.

If you are an employee who has paid business expenses out-of-pocket, you can deduct some or all of your business expenses by itemizing them on Schedule A of your personal income tax return.

Â

Business expense deductions for sole proprietors and self-employed taxpayersBusiness expenses are normally associated with corporations – entities which are distinct and separate from the owner(s) and employees. In most cases, business expenses are reported on a corporate income tax return instead of on a personal income tax return.

However, there are a variety of situations in which you, the taxpayer, may wish to deduct business expenses on your own personal income tax return. If you are a self employed professional, own a home-based business, or are a shareholder in an S-Corporation or partnership, your business deductions can be listed directly on (or passed through to) your personal income tax return.

If you are an employee who has paid business expenses out-of-pocket, you can deduct some or all of your business expenses by itemizing them on Schedule A of your personal income tax return.

Â

If you are the sole proprietor of an unincorporated business or an LLC (which is an unincorporated business to the IRS), you can deduct all qualifying business expenses directly on your income tax return by filing Schedule C. In order to be qualified as a business, you must engage in related business activities with “continuity and regularity” with the intent to make a profit.

Common examples of individuals who can claim Schedule C business expenses are self-employed professionals (contractors, consultants, photographers, etc), individuals who run a home-based business (such as a childcare service, a regular booth at a local market, etc). Most business activities that are not associated with an incorporated entity are reported on Schedule C.

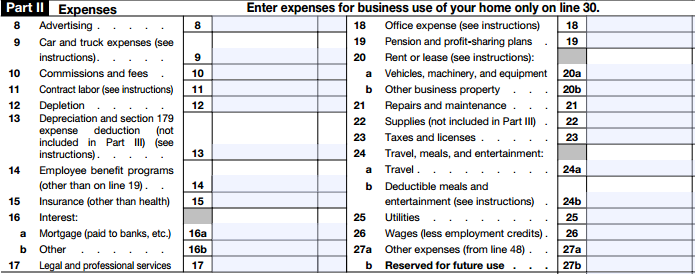

As the owner of a Schedule C business, you have the right to deduct all qualified business expenses from your gross business income – resulting in either a net gain, or a net loss, to your Adjusted Gross Income. You must list your deductions in the Business Expenses section of Schedule C (seen below), and retain receipts to prove your expenses in the event of an audit.

Business expense deductions for shareholders in an S-Corporation or Partnership

S-Corps and Partnerships are different from Schedule C businesses in that they can be owned by multiple shareholders. While these businesses are not subject to taxation like C-Corporations, business deductions in an S-Corp or a Partnership are reported on a business tax return and not on an individual shareholder’s tax return.

S-Corps and Partnerships are different from Schedule C businesses in that they can be owned by multiple shareholders. While these businesses are not subject to taxation like C-Corporations, business deductions in an S-Corp or a Partnership are reported on a business tax return and not on an individual shareholder’s tax return.

- An S-Corporation must report all business expenses  on Form 1120S, “U.S. Income Tax Return for an S Corporation”

- A partnership must report all business expenses on Form 1065, “U.S. Return of Partnership Income”

If the business has multiple shareholders, the deductions – like the income distributions – will effectively be equally distributed to all of the shareholders based on their investment in the company. If the business is owned by s sole shareholder, all of the deductions – and profit distributions – will flow through to that individual’s tax return as a distribution.

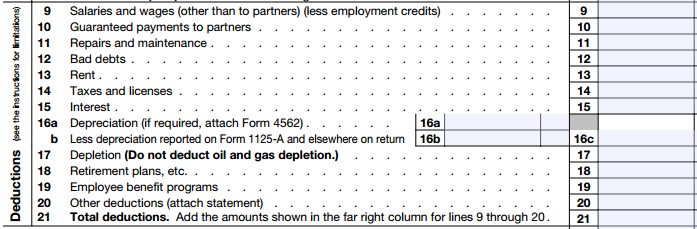

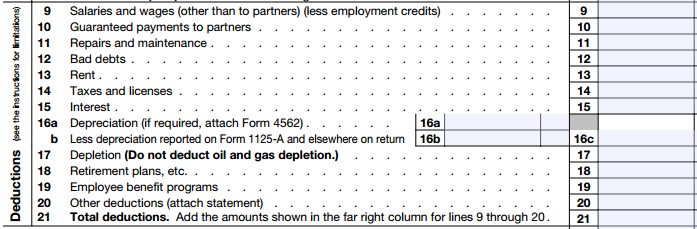

In addition to the normal deductible business expenses, S-Corps  and Partnerships also allow the easy deduction of wages, officer compensation, and employee benefits. See the excerpt the expenses section of Form 1065 (partnership income return) below.

Business expense deductions for employees with non-reimbursed business expenses

While fundamentally different from deducting expenses for a business in which you are an owner or shareholder, the IRS does provide a method for employees of a corporation to deduct business expenses they paid out-of-pocket. Generally, these expenses involve entertainment of clients (such as taking a client out to lunch to discuss business) or unreimbursed travel expenses (such as hotel or meal expenses).

If you itemize deductions on your personal income tax return, and your unreimbursed expenses amount to 2% or more of your AGI, you can itemize and deduct these expenses directly on your 1040. Keep in mind that general expense deduction rules, like the 50% entertainment deduction rule and mileage rates for business travel, also apply to employees claiming these expenses as an itemized deduction.

In addition to the normal deductible business expenses, S-Corps  and Partnerships also allow the easy deduction of wages, officer compensation, and employee benefits. See the excerpt the expenses section of Form 1065 (partnership income return) below.

Business expense deductions for employees with non-reimbursed business expenses

While fundamentally different from deducting expenses for a business in which you are an owner or shareholder, the IRS does provide a method for employees of a corporation to deduct business expenses they paid out-of-pocket. Generally, these expenses involve entertainment of clients (such as taking a client out to lunch to discuss business) or unreimbursed travel expenses (such as hotel or meal expenses).

If you itemize deductions on your personal income tax return, and your unreimbursed expenses amount to 2% or more of your AGI, you can itemize and deduct these expenses directly on your 1040. Keep in mind that general expense deduction rules, like the 50% entertainment deduction rule and mileage rates for business travel, also apply to employees claiming these expenses as an itemized deduction.

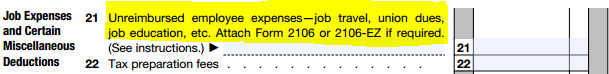

To claim unreimbursed business expenses, list the sum on Schedule A (your itemized deductions worksheet) under “Job Expenses and Certain Miscellaneous Deductions”. You must also also include Form 2106, “Employee Business Expenses”, where you must itemize your expenses and make sure they qualify for deduction.

How can we improve this page? We value your comments and suggestions!

How can we improve this page? We value your comments and suggestions! Send Instant Feedback About This Page

Donate BitCoin:

Donate BitCoin: